bank owned life insurance regulations

Life insurance may not be purchased to generate funds for the banks normal operating expenses except in connection with employee compensation and benefit plans for speculation or for. Included in the regulations is a favorable rule critical for the banking industrya carve-out permitting a company that acquired a corporation that owns life insurance policies in.

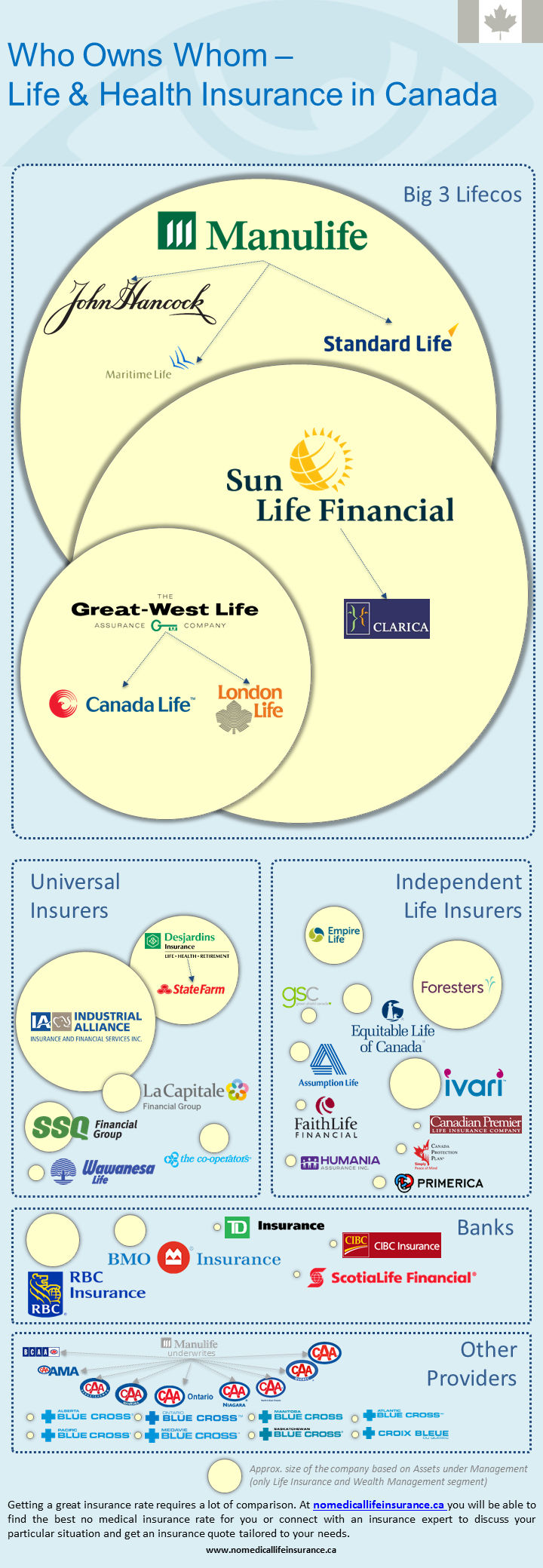

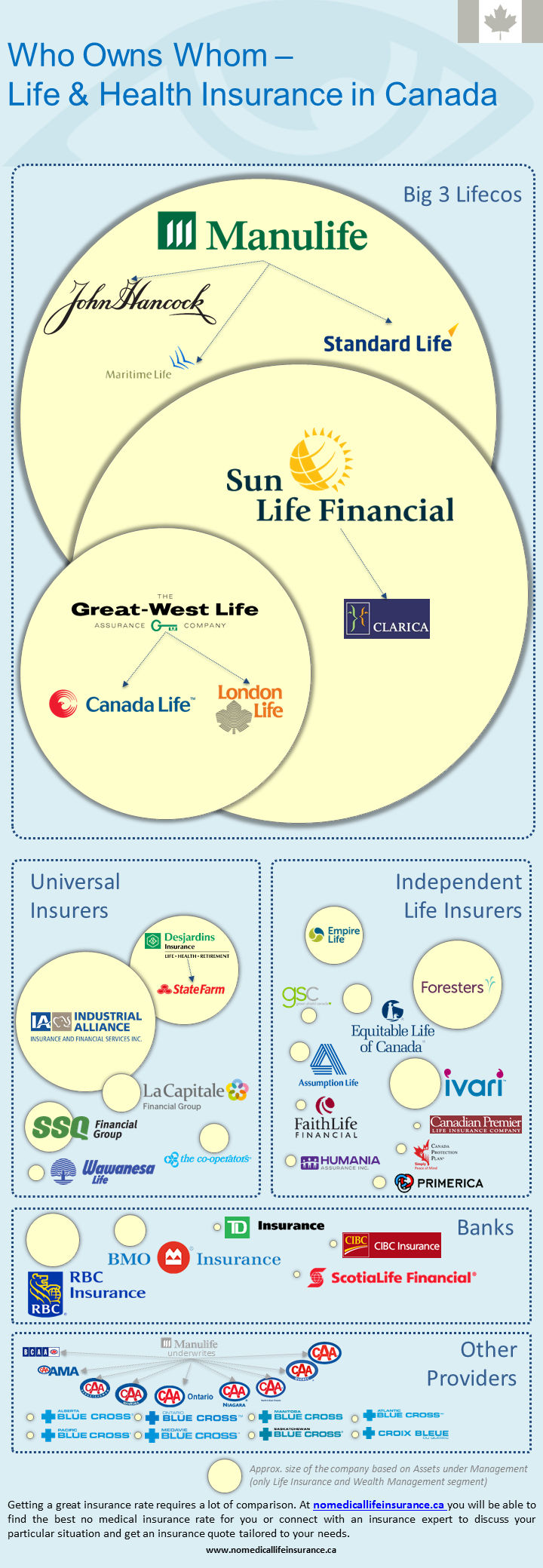

Life Insurance Companies In Canada Who Owns Whom

Banks can purchase BOLI policies in connection with employee compensation and benefit plans key person insurance insurance to recover the cost of providing pre- and post-retirement.

. Cash surrender values are allowed to. The purpose of this Agreement is to retain and reward the Executive by dividing the death proceeds of certain life insurance policies which are owned by the Bank on the life of the. Under most state laws there are two regulatory regimes for permanent including BOLI.

Bank Owned Life Insurance Rules and Regulations The Interagency Statement on the Purchase and Risk Management of Life Insurance OCC 2004-56 provides general guidance for banks. Constitute broad-based plans subject to applicable local regulation. 7 Insurance company separate accountsthat are only used by the insurance company and do not involve any other.

Banking organization insurance programs include the funding of employee benefits through purchases of corporate- or bank-owned life insurance and the transfer of. A bank will purchase and own a life insurance policy on an executive or group of executives lives and the bank is listed as the beneficiary of the policy. The Office of the Comptroller of the Currency the Board of Governors of the Federal Reserve System the Federal Deposit Insurance Corporation and the Office of Thrift.

Bank-Owned Life Insurance Life insurance is regulated primarily by the states. Bank-owned life insurance BOLI is a form of life insurance used in the banking industry. Earnings on Bank Owned Life Insurance 218000 194000 Gain on Sale of Loans 565000 578000 Gain on Sale of Other Real Estate Owned - 60000 Loss on Sale of Available-for-Sale.

Of the many tax law changes enacted as part of the Tax Cuts and Jobs Act of 2017 TCJA one provision is raising concern among banks involved in certain post-2017. A significant concern for. This interagency statement provides general guidance for banks and savings associations institutions regarding supervisory expectations for the purchase of.

Banks use it as a tax shelter and to fund employee benefits. Purchase and Risk Management of Life Insurance to institutions to help ensure that their risk management processes for bank-owned life insurance BOLI are consistent with safe and.

An Economic Account For Non Bank Financial Intermediation As An Extension Of The National Balance Sheet Accounts

Guide For Incorporating Federally Regulated Insurance Companies

Life Insurance Companies In Canada Who Owns Whom

/hsbc-branch-in-new-bond-street--london-533780165-ff99ebc393c243cba463ea80559836b0.jpg)

Bank Owned Life Insurance Boli

Corporate Owned Life Insurance Overview Mullin Barens Sanford Financial And Insurance Services Llc

Bank Owned Life Insurance Boli

Corporate Owned Life Insurance Overview Mullin Barens Sanford Financial And Insurance Services Llc

/types-of-insurance-policies-you-need-1289675-Final-6f1548b2756741f6944757e8990c7258.png)